A Hobsons Bay councillor is calling for change to how residential rates are calculated following skyrocketing property values.

His call has been backed by Maribyrnong ratepayers via an online petition calling for moves to protect property owners against sudden steep rises in rates.

As reported by Star Weekly, Maribyrnong and Hobsons Bay ratepayers are coming forward in droves to say their properties have been wildly over-valued, with some homes increasing in value by $735,000 in two years.

Cr Tony Briffa at last week’s council meeting flagged a motion calling on council officers to review property rates and charges as part of the development of the 2019-20 rating strategy.

The motion will ask officers to prepare a report that considers the impact of increasing values as well as options including for changes to differential rating structures.

“Residents are feeling financial stress as a result of wage increases not keeping pace with the cost of living pressures such as power, water, insurances and rates,” Cr Briffa said.

Cr Briffa said long-term residents in particular are seeing property values outstrip affordability.

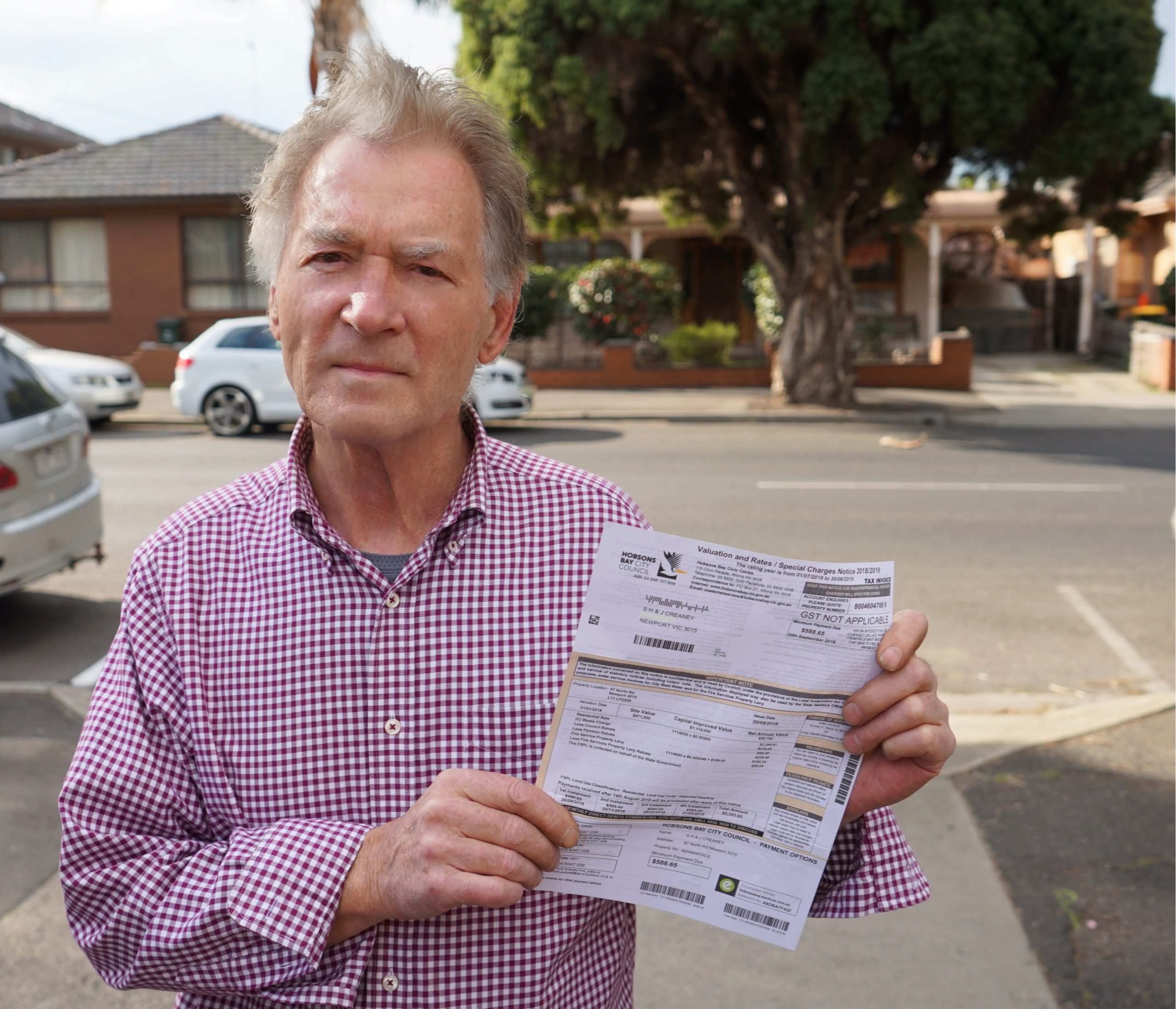

Newport resident Jerry Creaney started a Facebook group called Hobsons Bay Ratepayers for residents concerned about the rates hike.

“You have to understand that people, especially retired people or people on low incomes who happen to be living in the area …this could force them out of their homes,” he said. “The cost of living has gone through the roof and on top of this we get up to 45 per cent rate hikes.”

Maribyrnong resident Craig Mercer has collected almost 400 signatures via an online petition about the issue.

Maribyrnong council chief executive Stephen Wall told last week’s council meeting that property valuations were based on the market activity across the area. “In a perfect world, if no-one’s valuations moved, you would all see a movement in the amount of rates paid of 2.25 per cent,” he said. Mr Wall said new valuations of about 20,000 of Maribyrnong’s 36,000 residential properties rose at a higher than the average rate.

With Benjamin Millar